In today’s dynamic financial markets, understanding the performance of major tech stocks is crucial for investors. Google stock is one such stock that attracts a lot of attention. Google stock, as part of Alphabet Inc., has long been a staple in many portfolios due to its impressive growth and innovative capabilities. Investors and analysts keenly observe the Google stock price, especially during earnings seasons and product launches. It’s not just about knowing when to buy Google stock; a comprehensive Google stock analysis can provide deeper insights into its future trajectory. This blog will delve into various aspects, such as the latest Google stock news, its historical performance, and Google stock market trends, providing a well-rounded perspective for both experienced and novice investors.

- Current trends influencing Google stock

- Google stock analysis is detailed.

- Future expectations and Google stock forecast

- The latest Google stock news is affecting market performance.

An Overview of Google’s Market Performance

When discussing tech giants, it’s impossible to overlook Google. The company’s influence extends beyond search engines. But how has Google’s market performance trended recently? Let’s take a closer look, focusing on Google stock prices, investor sentiment, and market analysis.

Google’s financial health

Firstly, it’s essential to mention Google’s robust financial health. The company consistently reports strong earnings. This stability attracts a diverse pool of investors. More importantly, Google’s diversified portfolio ensures it can weather economic fluctuations.

Google Stock Price Trends

The Google stock price has been relatively stable in recent years. Despite market volatility, Google’s stock remains a preferred choice for investors. Why? Because the company continues to innovate. This ongoing innovation positively impacts their stock valuation.

Should you buy Google stock?

Many people often ask, “Should I buy Google stock?” While this decision is individual, several factors make Google an attractive investment:

- Consistent Revenue Growth: Google’s diverse offerings, ranging from ad services to cloud computing, drive steady revenue growth.

- Strong Market Position: Google dominates several markets, notably search engines and digital advertising.

- Continuous Innovation: Google consistently invests in new technologies, ensuring they stay ahead of the competition.

So, the consensus leans towards a ‘yes’ for investing in Google but always consult a financial advisor.

Examining Google’s market performance

Let’s delve into Google stock analysis. Various metrics suggest a strong, positive outlook. However, some aspects can be puzzling. For example, despite excellent quarterly results, stock prices sometimes dip. Why does this happen?

This could be due to market sentiment or external factors, such as economic policies. Investors should consider these complexities when analyzing the stock’s performance.

Final Thoughts

In conclusion, Google’s market performance remains robust, thanks to its consistent innovation and strong revenue streams. Whether you decide to buy Google stock or wait, monitor comprehensive Google stock analysis metrics to make an informed decision.

And there you have it—a closer look at Google’s market performance. Did some aspects confuse you? That’s normal. The market’s complexity ensures there’s always something new to learn.

Fintechzoom Google Stock

Historical Analysis of Google’s Stock Prices

Let’s delve into the past and examine the historical stock prices of Google, a company integral to the internet. Google’s journey from a humble search engine to an undeniable tech giant is not just a tale of innovation but also a fascinating financial saga. The rise of Google’s stock over the years mirrors its prolific growth and the significant role it plays in our lives today.

Early Years and IPO

Google’s initial public offering (IPO) in August 2004 was a momentous event. Priced at $85 per share, it stirred significant interest on Wall Street. Investors saw potential in Google’s innovative search engine capabilities, even though some skeptics doubted its long-term profitability. Fast forward to late 2004, and keen investors watched as the stock price surpassed initial expectations. By the end of 2004, Google’s stock was already trading at nearly double the IPO price. These early gains set the stage for what was to come.

Rapid Growth and Milestones

As Google expanded its suite of products and services, such as Gmail, Google Maps, and YouTube, its stock price experienced remarkable growth. During the mid-2000s, the buzz around tech stocks reached a fever pitch. By November 2007, Google’s stock had briefly crossed the $700 mark. Analysts touted these milestones, attributing them to the company’s innovative prowess and strategic acquisitions.

The 2008 financial crisis

Amid this growth, the 2008 financial crisis brought a period of uncertainty. Google, like many other companies, felt the sting. Its stock price dipped significantly, often mirroring the erratic movements of the broader market. Investors faced a dilemma: hold onto Google stock or liquidate? Despite turbulent waters, those who held on were likely glad they did. By mid-2009, the resilience of Google’s business model had shone through, leading to a recovery in stock prices.

Stability and continued growth

In the decade following the financial crisis, Google’s stock enjoyed periods of stability interspersed with impressive growth spurts. The introduction of new technologies like Android and the company’s forays into various industries bolstered investor confidence. Innovations and strategic moves kept the stock’s performance vibrant. By the end of 2019, shares had climbed to over $1,300, showcasing the company’s robust growth trajectory.

Current Trends and Future Projections

Today, Google’s parent company, Alphabet Inc., continues to be a darling on Wall Street. The stock trends reflect more than just revenue; they indicate investor confidence in Google’s ability to stay ahead in a rapidly evolving digital landscape. While we see fluctuating movements, Google stock performance usually rebounds quickly from dips. Analysts and investors eagerly follow Google stock news to make informed decisions. The forecasts, while varied, often predict continued prosperity owing to Google’s diversification and innovation.

In conclusion, a historical analysis of Google’s stock prices reveals a tapestry of resilience, innovation, and strategic foresight. Each peak and trough tells a story of how Google navigated myriad challenges and opportunities. Whether you’re an investor, a tech enthusiast, or just curious, Google’s financial journey offers invaluable insights into the world of high-stakes investing and unparalleled innovation.

Factors influencing Google’s stock market value

Understanding the factors that drive Google’s stock market value is a complex process. There are multiple factors at play, each intertwining with another, creating a rather perplexing web. Let’s delve into some of the key elements.

1. Financial performance

First and foremost, financial performance is a critical determinant. Investors keep a close eye on Google’s quarterly earnings reports. Revenues, net income, and profit margins—these figures provide a snapshot of the company’s health. When Google exceeds expectations, the stock often surges. On the flip side, if they fall short, you might see a dip.

2. Market trends and sentiments

Although financial performance plays a huge role, market trends and sentiment can be just as influential. Investor confidence can sway Google’s stock price. The prevailing economic conditions often influence this confidence. During times of economic stability, the market is generally optimistic. However, in uncertain times, even stalwarts like Google are not immune to fluctuations.

3. Technological innovation

Google thrives on innovation. Every new feature, product, or service can potentially influence the stock price. For instance, significant advancements in AI or cloud computing could boost investor confidence, leading to a positive market reaction. However, the pace of technological change also introduces uncertainty. Competitors continually evolve, which could threaten Google’s market share. Hence, it’s a double-edged sword.

4. The regulatory environment

The regulatory landscape adds another layer of complexity. Governments across the globe have intensified scrutiny of big tech companies. Antitrust lawsuits, data privacy regulations, and tax policies can all impact Google’s operations and profitability. For instance, a hefty fine from a regulatory body could dent their financials, causing a stock dip. Conversely, relaxed regulations might be a breath of fresh air for investors, buoying the stock value.

5. The competitive landscape

Competition is fierce in the tech world. Companies like Amazon, Facebook, and Apple are constantly pushing the envelope. This competitive pressure can significantly impact Google’s market position and, by extension, its stock value. Investors constantly assess Google’s ability to innovate and stay ahead. Any sign of faltering can trigger a sell-off. Yet, their market dominance often instills a sense of security among investors.

6. Global Economic Conditions

Finally, one cannot ignore the wider economic context. Global events and economic conditions heavily influence Google stock market trends. Factors like international trade policies, geopolitical tensions, and global pandemics can affect investor confidence and stock values. For instance, during the COVID-19 pandemic, even solid performers like Google experienced volatility. Economic recovery phases, however, often lead to an optimistic outlook.

In conclusion, while Google’s robust financials and market innovation are primary drivers, external factors like regulatory scrutiny, competition, and global economic conditions significantly impact its stock market value. Understanding these intricate dynamics can provide a clearer picture for both novice and seasoned investors.

Comparative Study: Google vs. Other Tech Giants

The tech industry is a bustling arena where giants like Google, Apple, Microsoft, and Amazon continually strive for supremacy. Each company has carved out a unique niche, leveraging its strengths to outpace the competition. However, Google’s influence and innovation often place it under a more intense spotlight. In this comparative study, we will delve into how Google stacks up against its counterparts, scrutinizing its diverse array of services, technological advancements, and market strategy. As we unravel these complexities, you’ll find some twists, and perhaps even a tinge of confusion.

Service portfolio and ecosystem

Google’s ecosystem is impressively vast. From search and advertising to mobile operating systems and cloud services, the company has a widespread influence. Compare this with its competitors:

- Google: search engine, Android OS, Google Cloud, Gmail, YouTube, Google Maps.

- Apple: iOS and macOS, Apple Music, iCloud, App Store, and Apple Pay.

- Microsoft: Windows OS, Azure Cloud, Office 365, LinkedIn, and Surface devices.

- Amazon: AWS (Amazon Web Services), Prime Video, Amazon.com marketplace, Alexa.

Google’s diversification allows it to mitigate risks. For instance, growth in cloud computing services can counterbalance any decline in advertising revenue. However, Apple’s strategy often relies on hardware sales coupled with tightly integrated software. Microsoft’s long-standing dominance in operating systems provides a stable revenue stream. Conversely, Amazon’s expertise in cloud services and e-commerce presents unique strengths that others might envy.

Innovation and technological advancements

When it comes to innovation, Google has consistently been an industry leader, especially in areas like artificial intelligence (AI) and machine learning. Yet, this doesn’t mean the other giants are lagging. Consider these examples:

- Google: Google Assistant (AI), TensorFlow (machine learning), self-driving cars (Waymo), Google Stadia (cloud gaming).

- Apple’s offerings include Siri (AI), custom silicon chips such as the M1, augmented reality (AR) applications, and innovative health solutions.

- Microsoft: HoloLens (AR), Cortana (AI), advanced cybersecurity tools, quantum computing research.

- Amazon: Echo & Alexa (AI), AWS advancements, drone delivery systems (Prime Air), cashier-less stores (Amazon Go).

Google’s AI initiatives, underscored by projects like TensorFlow and DeepMind, are revolutionary. But it’s the seamless integration with other Google services that stands out. Meanwhile, Apple’s focus on customer experience drives its innovations, as seen in their groundbreaking M1 chips. Microsoft, on the other hand, is pushing the envelope in areas like augmented reality and quantum computing. Amazon’s advancements in AI and robotics are also noteworthy, albeit often more consumer-oriented.

Market Strategy

Each tech giant adopts distinct market strategies that reflect its core strengths and business priorities. Google’s approach often focuses on open-source and mass adoption, resulting in a large user base. Apple, however, favors a more exclusive, premium market strategy. Microsoft focuses on enterprise solutions, while Amazon integrates services to streamline its e-commerce dominance. Let’s delve into these differences:

- Google is known for its open-source philosophy, similar to that of Android, its broad accessibility, and its aggressive market penetration through Google Ads.

- Apple: high-end product range, brand loyalty, and premium pricing strategy.

- Microsoft is known for its comprehensive software solutions, enterprise focus, and extensive partnerships.

- Amazon has a customer-centric approach, vast product selection, and innovative e-commerce strategies.

Google’s commitment to an open-source philosophy allows for a wider reach, helping it gain vast amounts of data, which is crucial for its AI projects. However, this strategy sometimes scatters focus across too many fronts. Apple’s premium pricing and exclusive ecosystem create strong brand loyalty but might not appeal to the cost-conscious consumer. Microsoft’s focus on business solutions ensures a steady revenue stream, but it can sometimes give its consumer products less attention. Meanwhile, Amazon’s customer-first strategy redefines retail but can sometimes stretch its resources thin across various ambitious projects.

The complexities in the tech world ensure that no single company can dominate every segment. Google’s diversified portfolio and innovative prowess keep it ahead in many areas, but its competitors bring their distinct advantages to the table. Navigating through these layers of strategies and innovations reveals a fascinating battleground where giants continuously redefine the future of technology.

Google’s Financial Statements: A Deep Dive

When we talk about tech giants, Google inevitably comes to mind. Its influence and reach are unparalleled. However, behind all the innovation and market presence lies something quite profound: its financial statements. Diving into these numbers isn’t just for financial analysts or investors; understanding these figures can give us a clearer picture of Google’s true strength and strategy.

First and foremost, let’s examine the revenue streams. At a glance, one might think it’s all about advertising. While advertising does form a significant chunk, there are numerous other avenues contributing to Google’s coffers. For instance, there’s revenue from cloud services, the ever-growing YouTube subscriptions, and even the Google Play Store.

However, the pie gets a bit muddled when you delve deeper. Yes, advertising constitutes around 80% of the income. A closer look shows that search ads aren’t the only source of ad revenue. There are display ads, video ads, and a multitude of other platforms contributing to this income. This multi-channel approach not only diversifies their revenue but also fortifies them against economic downturns.

Expense-wise, Google’s spending is as dynamic as its revenue streams. A significant portion goes towards R&D. This is hardly surprising given their constant push for innovation. However, the intricacies get intriguing here. While investments in artificial intelligence and machine learning are well known, there’s substantial spending on hardware research. Think about it: Google isn’t just a software company. It’s clear where some of that money is going with products like the Pixel series and the upcoming ventures into new hardware.

Operating expenses are another point of interest. Many assume that a major tech firm would have a streamlined process, but Google’s operation expenses are astonishingly varied. From hefty salaries for top-tier talent to the costs involved in maintaining massive data centers, the numbers tell the story of a company striving to balance growth and sustainability. And let’s not forget their acquisitions—from major buys like Fitbit to smaller, niche companies that bolster specific product lines.

But perhaps the most intriguing part of their financial statements is the cash on hand. Google’s reserves are nothing short of staggering. This isn’t just a rainy-day fund; this is a strategic war chest. With such substantial reserves, Google can afford to take risks, whether through acquisitions, expanding into new markets, or investing heavily in futuristic tech. It’s this solid financial backbone that often sets them apart from competitors, providing a cushion against market fluctuations and the freedom to innovate.

Yet, these numbers, while revealing, can be a tad confusing. For instance, understanding the difference between GAAP and non-GAAP figures in their reports can be confounding for someone not well-versed in financial jargon. Additionally, the implications of various tax structures and international revenue streams sometimes add layers of complexity.

To wrap things up, Google’s financial statements are more than just numbers. They reflect a financial robustness and strategic foresight that’s rare in the business world. Whether it’s their diverse revenue streams, their significant investments in R&D, or their colossal cash reserves, each element paints a picture of a company that’s not just surviving but thriving and consistently pushing the envelope.

The impact of product innovations on Google’s stock

Google’s name has become synonymous with innovation over the years. When we talk about product innovations at Google, we’re essentially discussing the lifeblood that sustains their market powerhouse status. But how exactly do these innovations affect Google’s stock performance?

First off, let’s consider Google’s AI advancements. Google is not only pushing the envelope with AI but essentially setting the bar. In recent years, the integration of AI into various Google services has been nothing short of transformative. From Google Search to YouTube recommendations, AI-generated suggestions have significantly improved the user experience. Consequently, these enhancements often lead to increased user engagement, which investors closely monitor. The more users interact with Google’s array of services, the better the advertisement revenue. It’s a simple equation, although sometimes the metrics involved may confuse even seasoned investors.

Then there’s Google Cloud—another frontier where Google is making strides. Cloud technology, although seemingly abstract, has become big business. Companies are increasingly migrating their operations to the cloud. This growing trend works in Google’s favor. Presenting robust and scalable cloud solutions can shift market dynamics. Investors see this as a sign of potential long-term growth. Google Cloud alone generated around $19 billion in revenue in 2022, which is quite compelling from a stock valuation perspective.

Google’s ventures into hardware, however, have been a mixed bag. Sure, the Pixel phone series and Google Home devices have carved out their niches. Yet, they remain dwarfed by competitors like Apple and Amazon. Sometimes, the stock reflects these market realities. When a new Pixel phone launches, you might see a slight uptick in stock prices. Nonetheless, it’s an area where Google has to tread carefully, given the intense competition. Success in hardware doesn’t come easily, and investors know this. They scrutinize every launch, seeking signs of viability and market reception.

One can’t overlook the role of government regulations and public perception in this equation. Regulatory scrutiny often casts a shadow over Google’s stock performance. Take, for example, the several antitrust lawsuits filed against the tech giant. Though these laws aim to ensure fair competition, they can dampen investor sentiment. Paradoxically, sometimes regulatory pressures can spur innovations, pushing Google to explore new avenues.

In sum, product innovations at Google have significant implications for its stock performance. AI advancements often lead to increased user engagement, positively affecting ad revenues. Cloud computing stands as a beacon of growth potential, and even the uncertain hardware sector contributes its share of excitement and anxiety. Regulatory concerns, while often a hindrance, can sometimes act as catalysts. Understanding these dynamics requires an insightful look—something that can sometimes get more complex than it needs to be, particularly when investor emotions enter the mix.

Conclusion

So, there you have it. The impact of product innovations on Google’s stock is multifaceted and somewhat circuitous. It involves a blend of technical prowess, market forces, and regulatory landscapes. Yet, one thing remains clear: Google’s relentless pursuit of innovation continues to be a major driver of its stock performance, offering investors both opportunities and challenges.

Evaluating Google’s Market Capitalization Over the Years

When we talk about the giants of the tech world, Google (or its parent company, Alphabet Inc.) often comes to mind. I find myself marveling at its journey, especially when considering its market capitalization—a key indicator of a company’s size and worth in the eyes of investors. But let’s be honest, tracking its growth isn’t as straightforward as it may seem.

Let’s first take a brief trip back in time. Larry Page and Sergey Brin founded Google in a humble garage in 1998. Fast forward to today, and it has transformed into a behemoth with various subsidiaries and countless services. What does this all mean for its market cap? Buckle up as we dive into this exciting yet somewhat convoluted adventure!

Initial Public Offering and Early Years

Google went public in August 2004 with an initial public offering (IPO) priced at $85 per share. Amazingly, on its first day, the stock price surged to over $100. The early buzz around Google proved justified as it managed to capitalize effectively on its innovative search engine capabilities.

In the initial years post-IPO, Google’s market capitalization saw a fairly steady rise. Investors were filled with optimism, as everything appeared remarkably promising. Sometimes, the staggering growth rates made one wonder if there was any limit to Google’s potential. Along the way:

- Innovative Products: Google continuously launched new products like Gmail, Google Maps, and Android, which largely contributed to its growing market capitalization.

- Advertising Revenues: Google’s advertising model, which revolutionized the targeting and delivery of ads, accounted for the lion’s share of its revenue.

- Strategic acquisitions, such as YouTube in 2006 and DoubleClick in 2007, increased Google’s market presence and equity value.

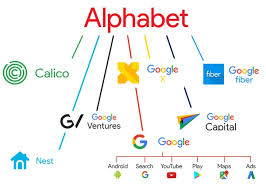

The Alphabet Restructure and Beyond

In 2015, Google underwent a corporate restructuring to become a wholly-owned subsidiary of Alphabet Inc., which would act as the umbrella company. This move added a layer of complexity that had both analysts and investors scratching their heads. The market cap, however, continued to soar, largely driven by diversification into areas such as self-driving cars, smart homes, and even health tech. Alphabet’s ambition seemed boundless, making it harder to dissect its market valuation in a single breath.

Recent Years and Present-Day Valuation

Jumping to the present day, Alphabet’s market capitalization continues to stun many. Recent years have seen the company climb up to become one of the most valuable entities globally, often contesting for the top spots with the likes of Apple, Microsoft, and Amazon.

However, the picture isn’t entirely void of challenges. We cannot ignore the hurdles of regulatory scrutiny, privacy concerns, and competitive pressures. Investors remain cautiously optimistic, but there’s always the shadow of uncertainty looming over such a colossal enterprise.

Concluding Thoughts

Evaluating Google’s market capitalization offers a roller-coaster of insights and surprises. While its journey from a garage startup to a global tech titan is awe-inspiring, it’s also filled with elements that keep both investors and casual observers on their toes. In essence, keeping up with Google, now Alphabet, is a delightful yet intricate puzzle, constantly forcing us to consider, recalibrate, and marvel.

For those keen on the world of tech investments, understanding Google/Alphabet’s market cap isn’t just about numbers—it’s about recognizing the dynamic interplay of innovation, strategy, and sometimes a bit of serendipity. And that’s where the real thrill lies.

Understanding Google Stock Trends: Investor Sentiments

The financial market often behaves as a complex web of diverse influences, particularly when it comes to tech giants like Google. Understanding investor sentiments can provide valuable insights into these trends, although, to the uninitiated, it might seem like deciphering an ancient script. As we delve deeper, the situation becomes both clearer and more perplexing, much like a well-crafted suspense novel.

Market reactions and perceptions

Investors tend to react swiftly to a myriad of factors, including quarterly earnings, innovation in product lines, and even regulatory news. For instance, when Google announces a breakthrough in AI technology, the stock often sees a surge. However, not all innovations elicit euphoria. Sometimes, concerns about ethical implications or feasibility can lead to mixed reactions. Consequently, what might appear as a sure win for Google’s stock can turn into a roller-coaster of unpredictability.

The media’s influence and public opinion

Then there’s the role of the media. Headlines focusing excessively on data breaches or antitrust lawsuits can cause investor confidence to waver. “Is this just a speed bump or a sign of rocky roads ahead?” investors ponder. Public sentiment, driven by the media, can exaggerate losses or gains. For instance, news of a privacy scandal might send the stock plummeting even if the actual impact on the company’s bottom line is minimal.

Moreover, social media platforms become reservoirs of both information and misinformation. Platforms such as Twitter function as dynamic arenas where opinions collide instantaneously. While some investors make well-informed decisions based on extensive research, others may react impulsively to trending discussions.

Emotional Investment

Besides rational analysis, emotions also play a significant role. Fear of missing out, or FOMO, can drive investors to buy Google stock at its peak, ultimately leading to buyer’s remorse when prices dip. On the flip side, panic selling during a minor drop can cause unnecessary losses. Here, investor psychology intertwines with market dynamics, creating a cycle that’s difficult to break.

The Human Element

In the end, understanding investor sentiment about Google’s stock involves mixing rigorous data with a soft touch of human intuition. Forecasts and algorithms provide one side of the story, but people’s hopes, dreams, and fears write another chapter. Both aspects are integral to a comprehensive view. When you look at Google’s stock from this holistic perspective, unpredictability and clarity begin to coexist, making the narrative as fascinating as the technology itself.

Therefore, while trends in Google stock may baffle and bewilder, they also hold the allure of a mystery, drawing us in time and again.

Google’s Stock Splits and Their Market Implications

When we talk about the world of tech giants, it’s impossible to overlook Google—or, should I say, Alphabet Inc., Google’s parent company. Over the past several years, Google has executed multiple stock splits. But what exactly are stock splits, and why do they matter to investors? Let’s dive into the details and unravel the complexities.

What is a stock split?

A stock split might sound complex, but it’s a rather straightforward concept. Essentially, it’s a corporate action that increases the number of shares in a company. The price of each share adjusts accordingly, ensuring that the overall value of the shareholder’s investment remains the same. For instance, a 2-for-1 stock split divides each share into two, resulting in a halving of its price.

Google’s historical perspective

Google has executed several stock splits over the years, the most significant being in 2014. They divided their stock into two classes: Class A and Class C. Class A shares have voting rights, while Class C shares, paradoxically, do not. Investors were confused—and quite understandably so—by this move. The intricate structure raised eyebrows, but Google, in its typically cryptic fashion, had its reasons.

Market implications and investor reactions

The immediate market reaction to a stock split often varies. In Google’s case, the splits generally aimed to make the stock more accessible to individual investors by reducing the price per share. However, some investors viewed the Class C shares as a ploy to maintain power within the company’s existing hierarchy. While this may sound like a conspiracy theory, it’s worth noting that Google exercises significant control over voting rights. This control ensures that founders and top executives retain substantial influence.

Impact on Shareholder Value

From a technical standpoint, a stock split doesn’t inherently affect the company’s market capitalization. Yet, it can lead to heightened trading activity and, sometimes, a temporary boost in the share price. Investors often perceive a split as a signal that the company’s stock has been performing well. This perception isn’t always accurate, but it can trigger more buying.

But there’s a twist. Not all splits are created equal. In some cases, companies may be splitting their stocks to disguise underlying issues, such as slowing growth or internal challenges. Google’s consistent performance, however, suggests their splits were more about making shares affordable and enhancing liquidity rather than masking problems.

Future Outlook

The future remains unpredictable. Will Google execute more splits? Possibly. As the company continues to evolve and expand into new markets, further splits could be on the horizon. Ultimately, the real question is: what will be the long-term implications for investors? As with any investment decision, it’s essential to conduct thorough research and consult financial advisors to understand the broader market dynamics.

In summary, Google’s stock splits are a fascinating subject with far-reaching market implications. They signal strategic intent and reflect the company’s approach to governance and shareholder engagement. Whether they succeed in their objectives is a matter of perspective and time.

So, the next time you see a headline about a Google stock split, remember: there’s more to it than meets the eye.

Future Projections: Where is Google Stock Headed?

As we delve into the potential future trajectory of Google stock, you’re bound to encounter a mix of optimism, skepticism, and every sentiment in between. Where is it headed? After all, the stock market is notoriously unpredictable. Nevertheless, some indicators can provide us with a sense of direction.

Alphabet Inc. (GOOGL), the parent company of Google, has consistently been a titan in the tech industry. The vast expanse of its ventures, from dominating internet searches to pioneering AI developments, keeps it in the limelight. But how does this translate into stock performance? Let’s break it down a bit.

The current market landscape

The current market landscape plays a crucial role in determining Google’s stock movements. The macroeconomic environment, including inflation rates, interest rates, and geopolitical unrest, directly impacts stock performance. For instance, in periods of economic instability, investors often seek safer havens, which may affect tech stocks like Google’s. However, Google’s diverse portfolio often provides a cushion against such market fluctuations.

Technical Analysis

Let’s dive into some technical analysis:

- Moving Averages: Google’s 50-day and 200-day moving averages provide insights into the stock’s short-term and long-term trends. A crossover between these two lines often indicates a shift in momentum.

- Relative Strength Index (RSI): This indicator shows whether the stock is overbought or oversold. Currently, Google’s RSI suggests it’s neither, pointing to a balanced state.

- Volume Trends: Increased trading volume suggests heightened investor interest. Recently, there’s been a steady rise in volume, hinting at possible future gains.

Metrics like these help investors gauge the market sentiment surrounding Google’s stock. But remember, they aren’t foolproof. External factors can disrupt even the most reliable patterns.

Growth Drivers

Several growth drivers could propel Google’s stock upward:

- AI Innovations: Google’s strides in artificial intelligence continue to set it apart. From improved search algorithms to advancements in machine learning, AI remains a key growth catalyst.

- Cloud Computing: Google Cloud has seen remarkable growth. As businesses increasingly migrate to the cloud, this segment offers immense potential.

- Advertising: Despite the rise of competitors, Google’s advertising revenue remains robust. Its ability to adapt to changing ad landscapes ensures it stays relevant.

However, the situation is not entirely positive. Challenges abound, such as regulatory scrutiny and competition from rivals like Amazon and Microsoft. Furthermore, the cyclical nature of the tech industry means that downturns are inevitable.

The bottom line

So, where is Google stock headed? While it’s impossible to predict with absolute certainty, one thing is clear: Google continues to innovate and adapt, ensuring it remains a dominant force in the tech world. Investors should monitor key growth drivers and market trends while remaining mindful of potential risks. In the swirling sea of stock market predictions, Google remains a buoyant vessel, charting its course through uncharted waters.

In conclusion, Google’s stock trajectory will likely reflect its ongoing commitment to innovation and its ability to navigate the evolving market landscape. While challenges are inevitable, the company’s strong foundations and visionary leadership offer reasons for continued optimism.

Frequently Asked Questions

What is the ticker symbol for Google’s stock?

Google’s stock ticker symbols are GOOGL for Alphabet Inc. Class A shares and GOOG for Class C shares.

Where is Google’s stock traded?

The NASDAQ stock exchange trades Google’s stock.

How can I buy Google stock?

You can buy Google stock through a brokerage account. Online platforms or a traditional broker can facilitate this process.

Has Google ever split its stock?

Yes, Google has split its stock. The most recent split was a 20-for-1 stock split, which took effect on July 15, 2022.

Does Google pay dividends to its shareholders?

No, Google does not currently pay dividends to its shareholders. The company reinvests its earnings into business operations and growth initiatives.

What factors influence Google’s stock price?

Factors such as company earnings, revenue growth, market conditions, technological advancements, and broader economic indicators influence Google’s stock price.

How can I track Google’s stock performance?

You can track Google’s stock performance through financial news websites, stock market apps, and Google Finance.

What was Google’s initial public offering (IPO) price?

Google’s initial public offering (IPO) price was $85 per share when the company went public on August 19, 2004.

Who are Google’s biggest shareholders?

Google’s largest shareholders include institutional investors such as mutual funds and pension funds, as well as Alphabet Inc.’s co-founders Larry Page and Sergey Brin.

Is it a favorable time to invest in Google stock?

The decision to invest in Google stock depends on individual financial goals, market conditions, and risk tolerance. We recommend consulting with a financial advisor before making any investment decisions.